- Email us: sales@msbdocs.com

eKYC for eSignature

Instantly confirm signer identities before documents are signed. Our eKYC-enabled eSignature platform lets organizations verify users securely and compliantly — reducing onboarding time, preventing fraud, and ensuring every document is signed by the right person.

Request a Demo

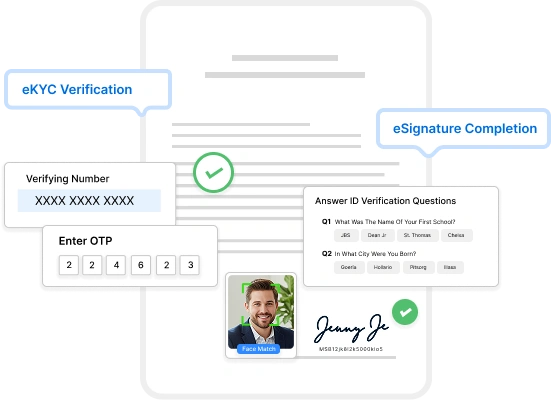

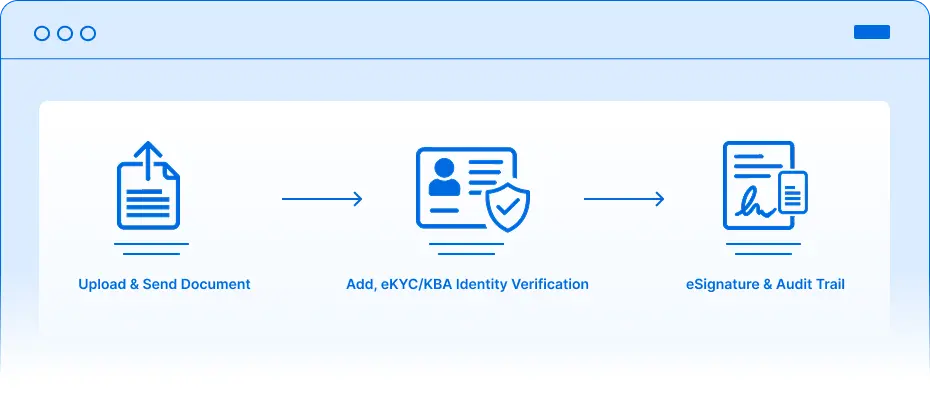

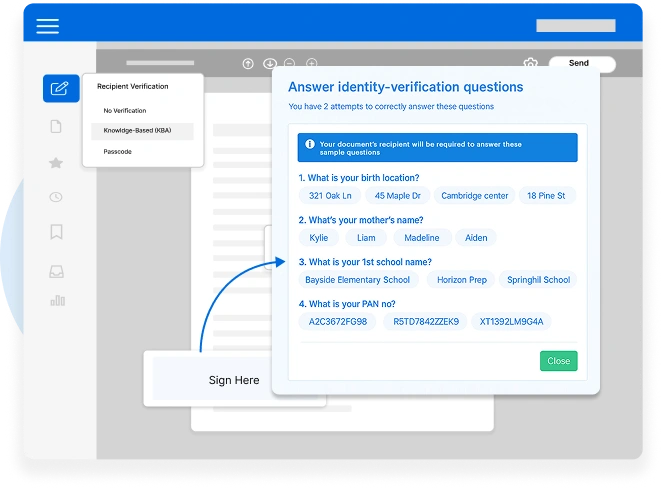

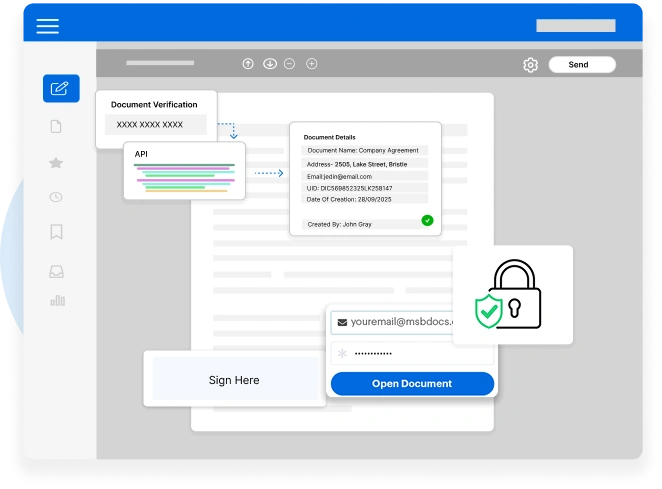

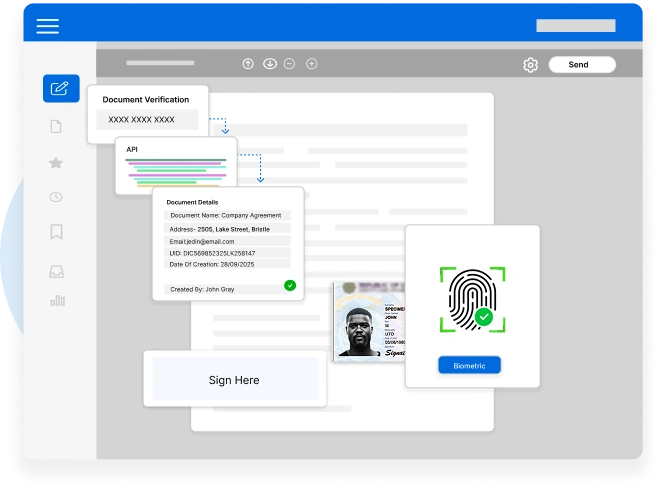

When a document is sent for signature, our eKYC layer automatically verifies the signer’s identity through document checks, knowledge-based authentication (KBA), or biometric verification — all within the same workflow. Once verified, the signer proceeds to sign, and the verified identity is permanently linked to the completed agreement.

Follow these simple steps to complete your stamping and signing process digitally

Reduce onboarding and signing times from days to minutes.

Stop unauthorized signers before documents are executed.

Meets Global Regulatory Standards

One secure workflow for verification, signature, and audit trail.

KBA enhances security for regulated industries such as banking, healthcare, life sciences, and insurance by verifying signers through personalized challenge-response questions derived from authoritative data sources.

Our eKYC system brings together document validation, biometric matching, and KBA into one secure platform. Businesses can verify customers, employees, or partners worldwide — with instant results and unified compliance.

Electronic Know Your Customer (eKYC) is a secure, paperless method of confirming a user’s identity digitally. It replaces manual verification with automated checks — validating IDs, biometrics, and data sources in seconds.

For eSignature workflows, eKYC ensures every signer is verified, every document is compliant, and every transaction builds trust.