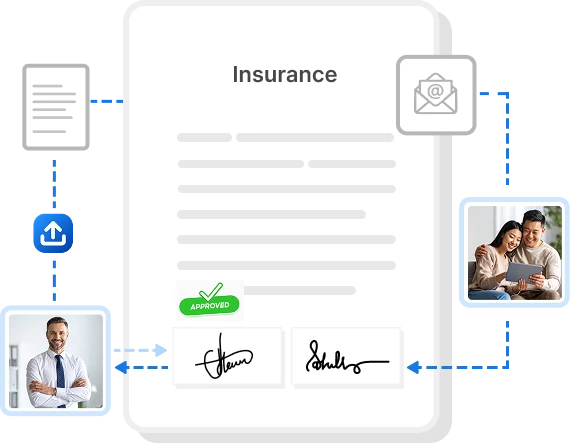

Easily Collect eSignatures from Insurance Clients

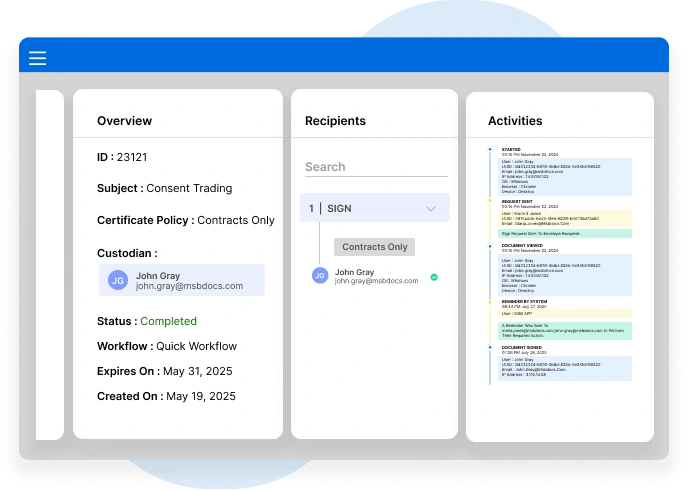

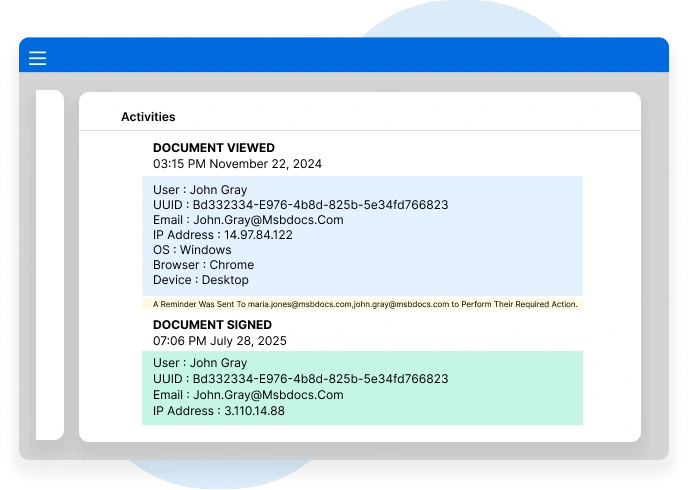

Track signatures in real time to know exactly who signed, who hasn’t, and when. No more chasing documents or guessing status.

Insurance Document Automation

Automate insurance documentation for issuance, endorsements, and claims—ensuring data security, compliance, and reduced errors, processing time, and paperwork.

Start Free Trial

Track signatures in real time to know exactly who signed, who hasn’t, and when. No more chasing documents or guessing status.

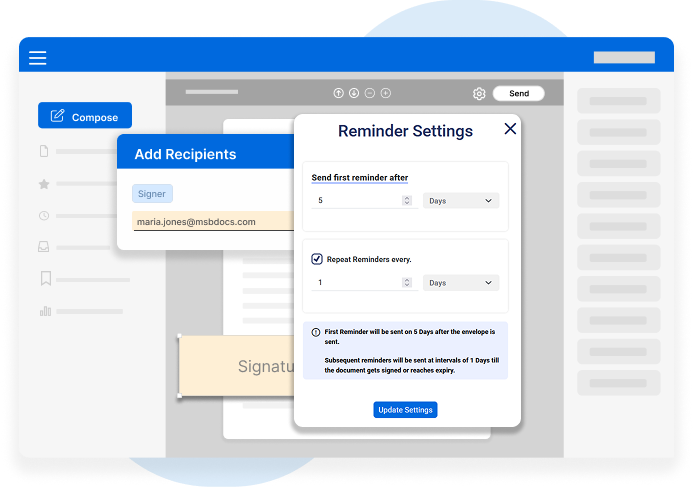

Set a future start date for reminders so clients receive notifications only when needed. The system automatically triggers follow-ups from that date, preventing early or unnecessary alerts.

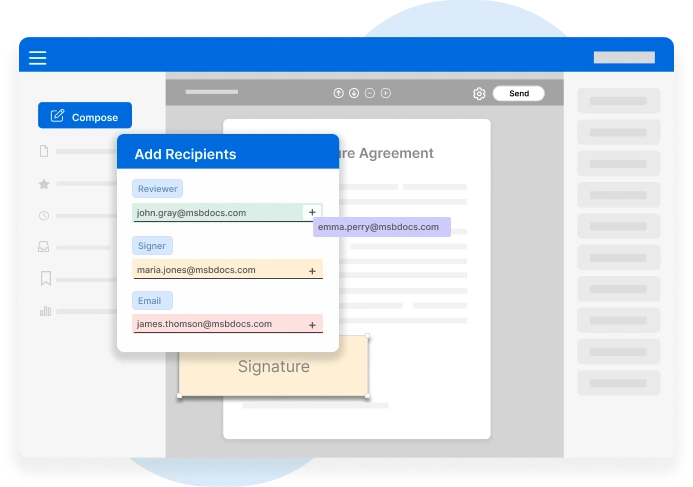

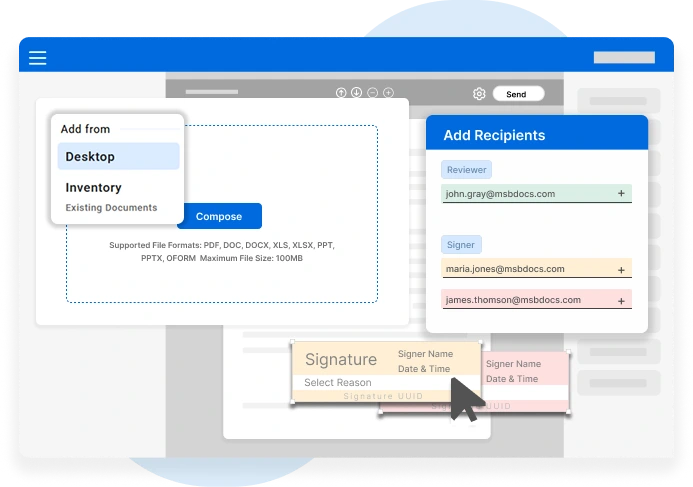

Group related documents (like policy forms, declarations, and disclosures) and send them together for faster, structured signing, reducing administrative overhead.

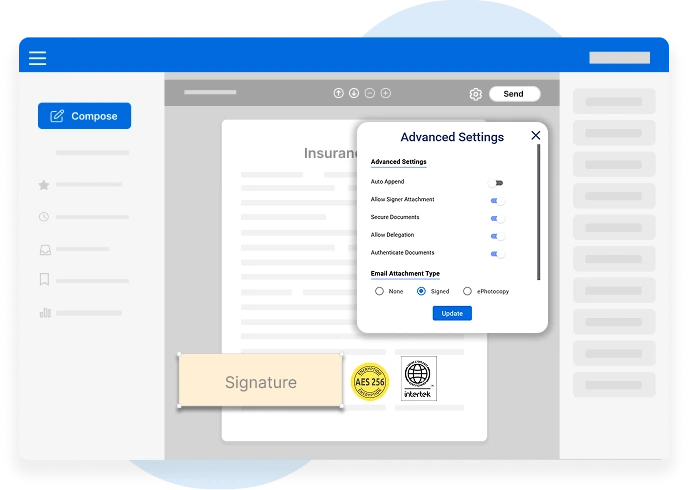

Safeguard sensitive insurance data using two-factor authentication, AES 256-bit encryption, and role-based access controls aligned with regulatory requirements.

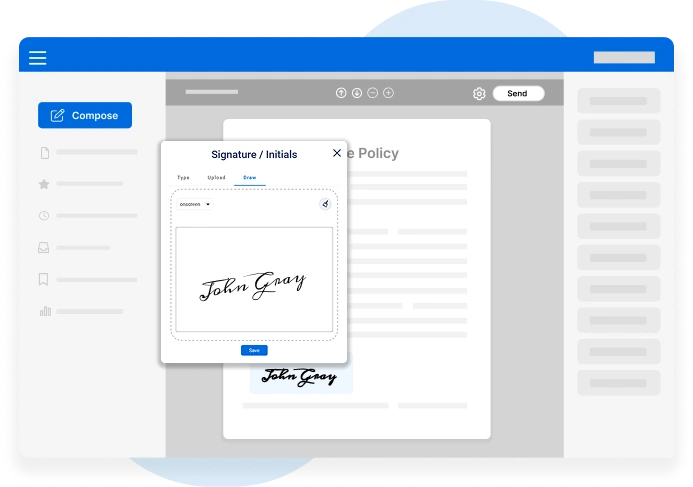

Enable clients and agents to draw or upload their signature and complete forms securely from any device, desktop, tablet, or smartphone with no app required.

Automatically record every action including, timestamps, signer names, email IDs, and IP addresses, to maintain a tamper-proof audit trail for compliance and legal assurance.

Digitize document processes to lower printing, courier, and storage costs. Free up your teams from manual tasks like data entry and paper management.

Complete insurance paperwork faster with secure digital signing. Reduce delays and deliver a smoother experience for customers.

eSign KYC documents, identification proofs, and welcome agreements for quick onboarding.

Digitally execute life, health, auto, and property policy applications to reduce manual paperwork.

Approve premium quotes, benefit illustrations, and proposal summaries securely.

Capture customer consent for terms, privacy policies, and mandatory disclosures.

Authorize and sign beneficiary details electronically for faster processing.

eSign issued policies to finalize and activate coverage instantly.

Capture customer acknowledgment for issued policy schedules and coverage terms.

Approve coverage limits, deductibles, and optional add-on benefits.

Sign off on mid-term policy changes or coverage modifications.

Execute agreements for additional riders or specialized covers.

Digitally approve policy renewals to avoid lapses.

File and sign claim forms for health, motor, and property insurance.

Approve surveyor and police reports electronically for faster claim assessment.

Authorize medical providers to share treatment and diagnostic records.

Sign surveyor evaluations, inspection checklists, and claim valuation reports.

Approve documents for complete loss settlements.

Finalize claim settlements with eSigned agreements.

Sign anti–money laundering declarations, risk assessment reports, and verification records.

Execute tax residency and financial compliance forms digitally.

Capture signatures for GDPR/DPDP compliance and personal data use consent.

Approve actuarial and risk analysis documentation.

Sign insurer filings, compliance statements, and regulatory submissions.

Approve regulatory audit reports and compliance certifications.

Execute contracts with third-party administrators for claims processing.

Sign service provider agreements for cashless networks.

Approve vendor enrollment forms and confidentiality agreements.

Sign performance and quality commitment agreements.

Digitally execute commission structure and incentive agreements.

eSign appointment letters, HR forms, and employment contracts.

Approve compliance training completion and certification records.

Execute NDAs for sensitive insurance data handling.

Sign appraisal forms and goal-setting documents.

Approve travel, claim-related, and operational expense forms.

Digitally confirm policy continuations before expiry.

Approve cancellation and refund requests securely.

Sign reinstatement forms for lapsed policies.

Authorize recurring premium deductions or adjustments.

Approve complaint resolution and closure documentation.