New Account Opening & Customer Onboarding

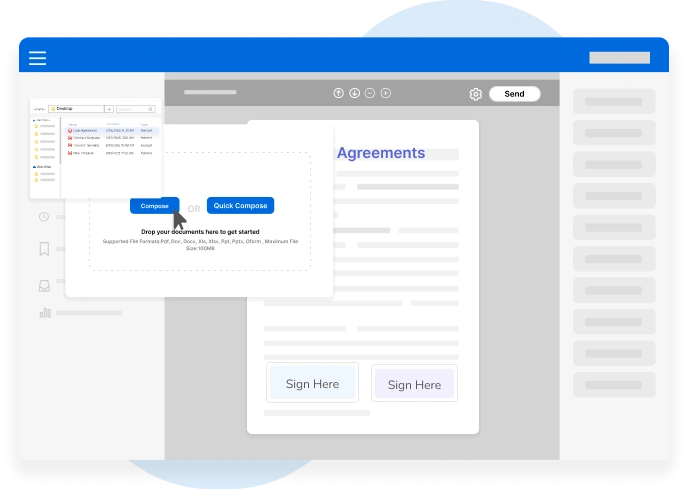

Digital Account Opening Forms:

Complete savings, current, corporate, and investment account openings with secure eSignatures.

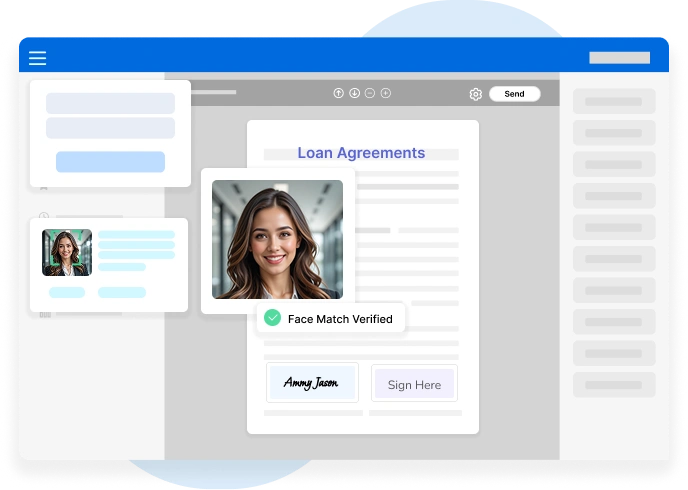

KYC & eKYC Processing:

Capture and verify identity documents, address proofs, and PAN cards through Aadhaar eKYC or OTP

verification.

Customer Data Collection:

Automate the intake of personal and financial details, ensuring accuracy and eliminating duplicate entries.

Regulatory Compliance:

Meet RBI and AML guidelines by capturing required declarations and risk assessment forms digitally.

Service Agreements & Disclosures:

eSign welcome kits, terms of service, and account-related disclosures instantly.

Multi-Channel Onboarding:

Enable customers to initiate and complete the onboarding process from mobile, web, or in-branch kiosks.

Credit Card Applications

eKYC Integration:

Integrates directly with eKYC APIs to verify applicant identity in real-time, reducing manual review time.

Digital Form Autofill:

Pre-populates customer data from CRM or banking systems into credit card application forms.

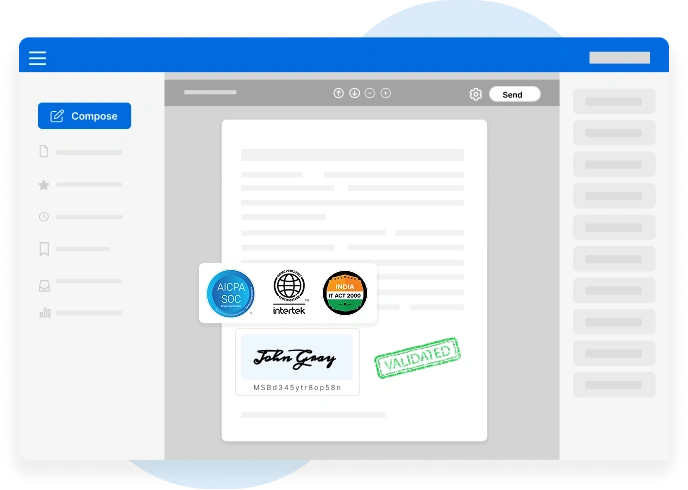

eSignature Authentication:

Uses multi-factor authentication and digital certificates for secure signing of applications and consent

forms.

Document Validation & OCR:

Automatically scans and validates uploaded ID proofs, income statements, and address documents using OCR.

Automated Credit Bureau Checks:

Connects with credit bureau APIs to fetch credit history instantly.

Workflow Routing & Approval Tracking:

Routes applications to the right department and tracks approval status in real-time.

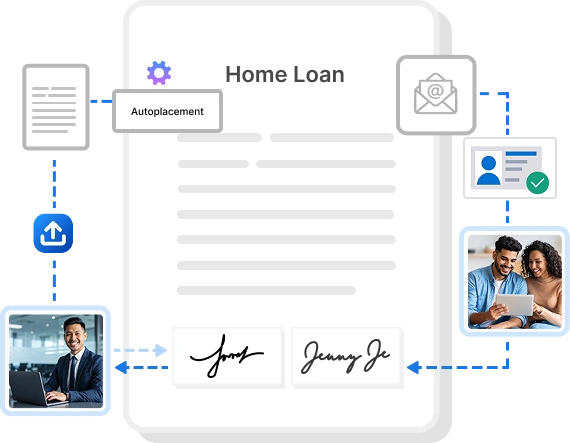

Loan & Mortgage Applications

Integrated eKYC & AML Screening:

Verifies borrower identity and conducts AML checks in real-time.

Smart Form Pre-Population:

Auto-fills loan application data from existing customer records or CRM systems.

eSignature with MFA:

Secures loan agreements and disclosures using encrypted signatures and OTP verification.

OCR-Based Document Verification:

Extracts and validates information from income proofs, property papers, and ID documents.

Automated Credit Scoring Integration:

Connects directly to credit bureau APIs for instant score retrieval and risk assessment.

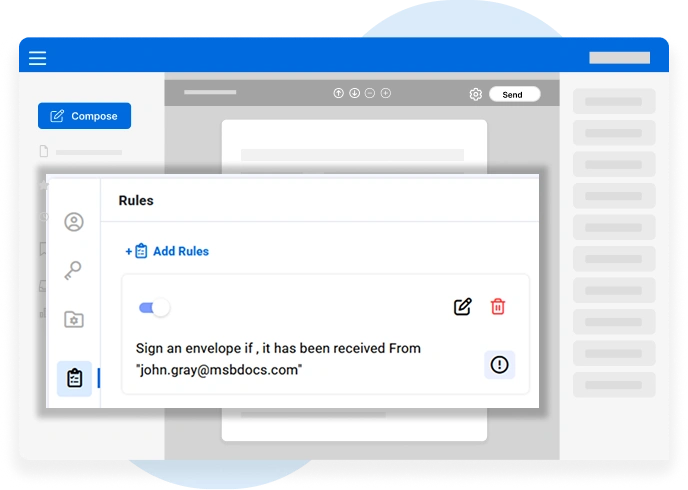

Rule-Based Workflow Routing:

Routes applications to underwriters, legal teams, or risk officers based on parameters.

Account Maintenance Requests

Digital Change Request Forms:

Pre-filled, authenticated forms for updates like address or nominee changes.

eSignature for Account Modifications:

Legally binds customer authorizations for account changes.

KYC & Identity Revalidation:

Integrates with eKYC APIs to re-verify identity for compliance.

Automated Service Request Routing:

Uses workflow automation to assign requests to the right department.

Linked Product & Service Updates:

Syncs changes across linked savings, loans, cards, and investment accounts.

OCR-Based Document Capture:

Extracts and validates data from submitted proof documents instantly.

Asset Transfers

eKYC & Ownership Verification:

Confirms the identity of both parties and validates ownership records in real-time.

eSignature with MFA:

Secures transfer deeds and agreements with encrypted signatures.

Smart Contract Templates:

Auto-generates legally compliant transfer documents with CRM or registry data.

Blockchain-Based Transfer Recording:

Registers ownership change on a tamper-proof blockchain ledger.

Automated Regulatory Filings:

Integrates with registries to submit transfer details instantly.

Digital Audit Trails:

Logs every action, signature, and document version during transfers.

Regulatory Disclosures

Template-Driven Compliance Forms:

Uses pre-approved digital templates aligned with regulatory formats.

Secure eSignatures & eStamps:

Authenticates disclosures with encrypted eSignatures and eStamps.

Automated Data Population:

Pulls required disclosure data from ERP, CRM, or compliance databases.

Version Control & Change Logs:

Tracks every edit, approval, and disclosure update with timestamps.

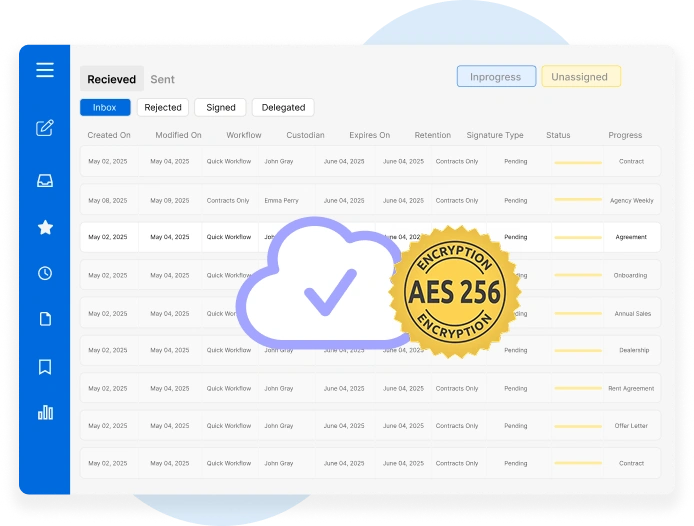

Encrypted Document Storage:

Stores disclosures in secure repositories with access controls.

Regulator Portal Integration:

Directly submits disclosures to regulator portals via API.

Checking & Savings Account Forms

Digital Account Opening Kits:

Pre-configured eForms for KYC, FATCA, and personal details collection.

Instant eSign & eKYC:

Verifies customer identity in minutes using Aadhaar or video KYC.

Automated Form Validation:

Ensures mandatory fields and signatures are complete before submission.

Workflow Routing:

Sends forms automatically to branch managers or compliance officers.

Audit-Ready Records:

Maintains tamper-proof records for audits or disputes.

Seamless Core Banking Integration:

Pushes verified data directly into CBS systems.

Proof of Identity Verification (eKYC)

API-Driven Identity Validation:

Connects to Aadhaar, PAN, and government databases for real-time validation.

Biometric Authentication:

Uses fingerprint, facial recognition, or iris scans for verification.

Liveness Detection:

Employs AI-powered video KYC with liveness checks.

Encrypted Data Transmission:

Protects personal data with AES-256 and TLS encryption protocols.

Automated Document OCR:

Extracts and validates ID details from submitted documents.

Immutable Audit Trail:

Records every verification step with timestamps and digital signatures.

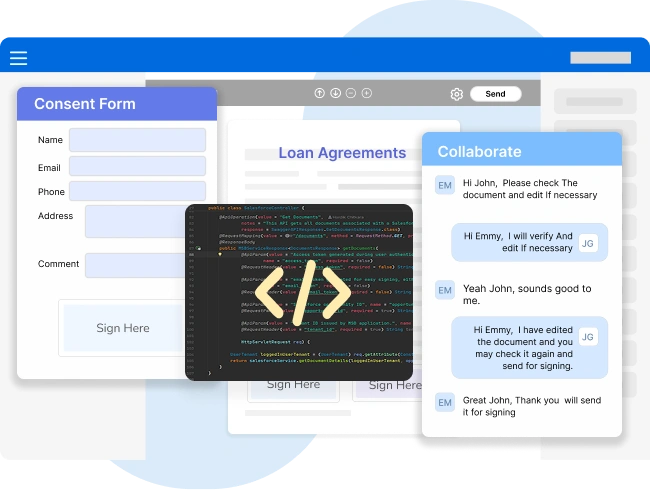

Consent & eConsent Forms

Time-Stamped eSignatures:

Captures legally binding, time-stamped electronic signatures with MFA.

Dynamic Consent Templates:

Uses customizable templates to meet regulatory standards.

Real-Time Consent Tracking:

Monitors consent status in dashboards for compliance.

Secure Storage & Encryption:

Stores signed consent documents in encrypted cloud repositories.

Audit Logs & Compliance Reporting:

Maintains immutable logs of consent events for audits.

Automated Renewal & Revocation:

Supports scheduled renewals and revocation through workflows.